A: | | The Board of Directors (the “Board”) of Hasbro, Inc. (the “Company” or “Hasbro”) is making these proxy materials available to you on the Internet, or sending printed proxy materials to you in certain situations, including upon your request, beginning on or about April 2, 2019, in connection with Hasbro’s 2019 Annual Meeting of Shareholders (the “Meeting”), and the Board’s solicitation of proxies in connection with the Meeting. The Meeting will take place at 11:00 a.m. local time on Thursday, May 16, 2019 at Hasbro’s corporate offices, 1027 Newport Avenue, Pawtucket, Rhode Island 02861. The information included in this Proxy Statement relates to the proposals to be voted on at the Meeting, the voting process, the compensation of Hasbro’s named executive officers and Hasbro’s directors, and certain other information. Hasbro’s 2018 Annual Report to Shareholders is also available to shareholders on the Internet and a printed copy will be mailed to shareholders upon their request.| Q: | Why are these materials being made available to me? |

Q: | | What proposals will be voted on at the Meeting? |

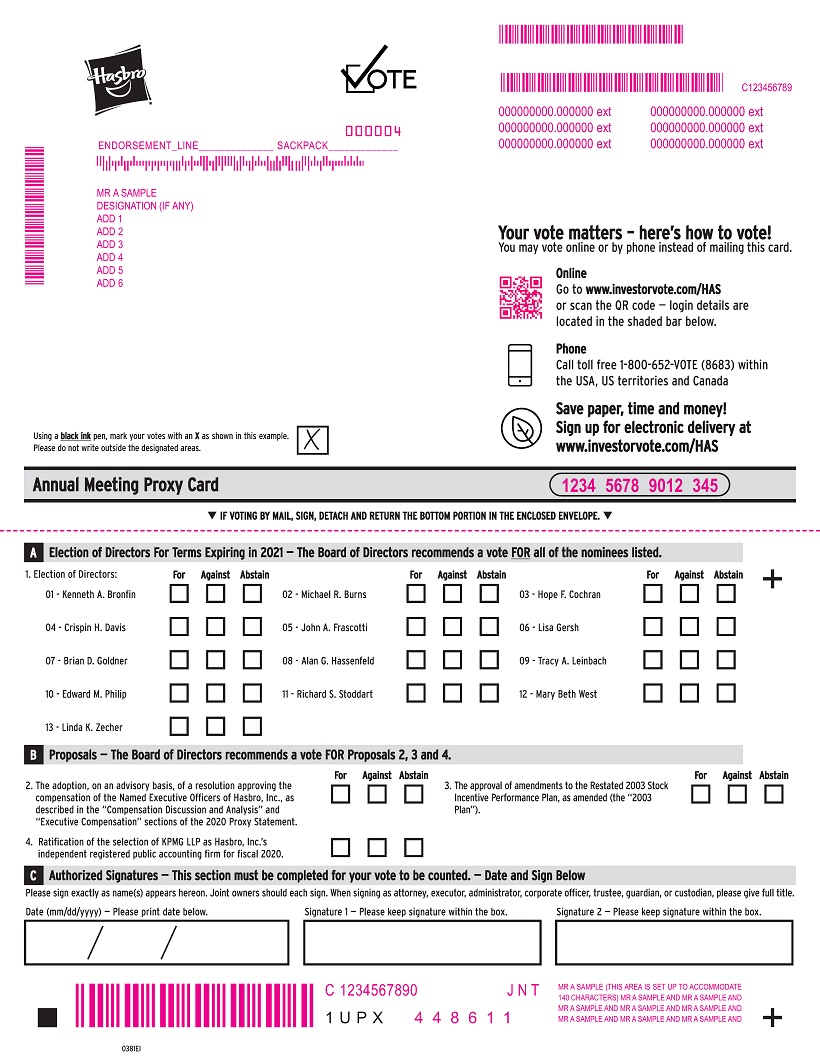

| A: | The Board of Directors (the “Board”) of Hasbro, Inc. (the “Company” or “Hasbro”) is making these proxy materials available to you on the Internet, or sending printed proxy materials to you in certain situations, including upon your request, beginning on or about April 1, 2020, in connection with Hasbro’s 2020 Annual Meeting of Shareholders (the “Meeting”), and the Board’s solicitation of proxies in connection with the Meeting. A: | | There are three proposals scheduled to be voted on at the Meeting: |

Proposal 1— Election of thirteen directors.

| Proposal 2— An advisory voteThe Meeting will take place at 11:00 a.m. local time on Thursday, May 14, 2020 at Hasbro’s corporate offices, 1027 Newport Avenue, Pawtucket, Rhode Island 02861 and virtually via the Internet at www.meetingcenter.io/227440037. The information included in this Proxy Statement relates to approvethe proposals to be voted on at the Meeting, the voting process, the compensation of the Company’sHasbro’s named executive officers.

officers and Hasbro’s directors, and certain other information. Hasbro’s 2019 Annual Report to Shareholders is also available to shareholders on the Internet and a printed copy will be mailed to shareholders upon their request. |

Proposal 3— Ratification | As noted above, as part of our precautions regarding the selectioncoronavirus orCOVID-19, we are also holding our meeting virtually on the Internet. If we are unable to have the meeting at our offices, we will announce our decision to hold the meeting only virtually via the Internet. To participate in the meeting virtually via the Internet, please visit www.meetingcenter.io/227440037. The password for the meeting is HAS2020. To participate in the meeting virtually as a registered shareholder you will need the control number included on your Notice of KPMG LLP as the Company’s independent registered public accounting firm for fiscal 2019. Internet Availability of Proxy Materials or your proxy card. Q: | | Why did I receive a Notice of the Internet Availability of Hasbro’s Proxy Materials, instead of a full set of printed proxy materials? |

| If you hold your shares through an intermediary, such as a bank or broker, you must register in advance to attend the Annual Meeting virtually on the Internet. Please refer to the instructions in “How do I register to attend the meeting virtually via the Internet?” below. A: | | Rules adopted by the Securities and Exchange Commission allow us to provide access to our proxy materials over the Internet instead of mailing a full set of such materials to every shareholder. We have sent a Notice of Internet Availability of Hasbro’s Proxy Materials (the “Notice”) to our shareholders who have not requested to receive a full set of the printed proxy materials. Because of certain legal |

| requirements, shareholders holding their shares through the Hasbro 401(k) Retirement Savings Plan were mailed a full set of proxy materials this year. Our other shareholders may access our proxy materials over the Internet using the directions set forth in the Notice. In addition, by following the instructions in the Notice, a shareholder may request that a full set of printed proxy materials be sent to them. |

| Q: | What proposals will be voted on at the Meeting? |

| | We have chosen to send the Notice to shareholders, instead of automatically sending a full set of printed materials to all shareholders, to reduce the impact of printing our proxy materials on the environment and to save on the costs of printing and mailing incurred by the Company.| A: | There are four proposals scheduled to be voted on at the Meeting: |

Proposal 1 — Election of thirteen directors. Proposal 2 — An advisory vote to approve the compensation of the Company’s named executive officers. Proposal 3 — Approval of amendments to the Hasbro, Inc. Restated 2003 Stock Incentive Performance Plan, as amended (the “2003 Plan”). Proposal 4 — Ratification of the selection of KPMG LLP as the Company’s independent registered public accounting firm for fiscal 2020. | Q: | Why did I receive a Notice of the Internet Availability of Hasbro’s Proxy Materials, instead of a full set of printed proxy materials? |

Q: | | How do I access Hasbro’s proxy materials online? |

| A: | Rules adopted by the Securities and Exchange Commission (“SEC”) allow us to provide access to our proxy materials over the Internet instead of mailing a full set of such materials to every shareholder. We have sent a Notice of Internet Availability of Hasbro’s Proxy Materials (the “Notice”) to our shareholders who have not requested to receive a full set of the printed proxy materials. Because of certain legal requirements, shareholders holding their shares through the Hasbro 401(k) Retirement Savings Plan were mailed a full set of proxy materials this year. Our other shareholders may access our proxy materials over the Internet using the directions set forth in the Notice. In addition, by following the instructions in the Notice, a shareholder may request that a full set of printed proxy materials be sent to them. A: | | The Notice provides instructions for accessing the proxy materials for the Meeting over the Internet, including the Internet address where those materials are available. Hasbro’s Proxy Statement for the Meeting and 2018 Annual Report to Shareholders can be viewed on Hasbro’s website at https://investor.hasbro.com/financial-information/annual-meeting. |

| We have chosen to send the Notice to shareholders, instead of automatically sending a full set of printed materials to all shareholders, to reduce the impact of printing our proxy materials on the environment and to save on the costs of printing and mailing incurred by the Company. |

| Q: | How do I access Hasbro’s proxy materials online? |

Q: | | How do I request a paper copy of the proxy materials? |

| A: | The Notice provides instructions for accessing the proxy materials for the Meeting over the Internet, including the Internet address where those materials are available. Hasbro’s Proxy Statement for the Meeting and 2019 Annual Report to A: | | Paper copies of Hasbro’s proxy materials will be made available at no cost to you, but they will only be sent to you upon request. To request a paper copy of the proxy materials follow the instructions on the Notice that you received. You will be able to submit your request for copies of the proxy materials by sending an email to the email address set forth in the Notice, by going to the Internet address set forth in the Notice or by calling the phone number provided in the Notice. |

Q: | | What shares owned by me can be voted? |

A: | | All shares of the Company’s common stock, par value $.50 per share (“Common Stock”) owned by you as of the close of business on March 20, 2019, therecord date, may be voted by you. These shares include those (1) held directly in your name as theshareholder of record, including shares purchased through the Computershare CIP, a Direct Stock Purchase and Dividend Reinvestment Plan for Hasbro, Inc., and (2) held for you as thebeneficial ownerthrough a broker, bank or other nominee. |

| | | | | | | |

1 | |  | | H A S B R O 2 0 1 9 P R O X Y S T A T E M E N T

| Shareholders can be viewed on Hasbro’s website at https://investor.hasbro.com/financial-information/annual-meeting. |

Q: | | What is the difference between holding shares as a shareholder of record and as a beneficial owner? |

| Q: | How do I request a paper copy of the proxy materials? |

A: | | Most Hasbro shareholders hold their shares through a broker, bank or other nominee rather than directly in their own name as the shareholder of record. As summarized below, there are some distinctions between| A: | Paper copies of Hasbro’s proxy materials will be made available at no cost to you upon request. To request a paper copy of the proxy materials follow the instructions on the Notice that you received. You will be able to submit your request for copies of the proxy materials by sending an email to the email address set forth in the Notice, by going to the Internet address set forth in the Notice or by calling the phone number provided in the Notice. |

| Q: | What shares owned by me can be voted? |

| A: | All shares of the Company’s common stock, par value $.50 per share (“Common Stock”) owned by you as of the close of business on March 18, 2020, therecord date, may be voted by you. These shares include those (1) held of record and those owned beneficially. |

Shareholder of Record

If your shares are registered directly in your name with Hasbro’s Transfer Agent,as theshareholder of record, including shares purchased through the Computershare Trust Company, N.A. (“Computershare”)CIP, a Direct Stock Purchase and Dividend Reinvestment Plan for Hasbro, Inc., and (2) held for you are considered, with respect to thoseas thebeneficial ownerthrough a broker, bank or other nominee.

|

| Q: | What is the difference between holding shares as a shareholder of record and as a beneficial owner? |

| A: | Most Hasbro shareholders hold their shares through a broker, bank or other nominee rather than directly in their own name as the shareholder of record. As summarized below, there are some distinctions between shares held of record and those owned beneficially. |

Shareholder of Record If your shares are registered directly in your name with Hasbro’s Transfer Agent, Computershare Trust Company, N.A. (“Computershare”), you are considered, with respect to those shares, the shareholder of record (or a registered shareholder). As the shareholder of record, you have the right to grant your voting proxy directly to the individuals named as proxies by Hasbro or to vote in person at the Meeting. Beneficial Owner If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the beneficial owner of shares held in street nameand your broker, bank or other nominee is considered, with respect to those shares, the shareholder of record.As the beneficial owner, you have the right to direct your broker, bank or other nominee on how to vote and are also invited to attend the Meeting.Meeting in person or virtually. However, since you are not the shareholder of record, you may not vote these shares in person or virtually at the Meeting unless you receive a legal proxy from your broker, bank or other nominee. Your broker, bank or other nominee has provided voting instructions for you to use. If you wish to attend the Meeting and vote in person or virtually via the Internet during the Meeting, please mark the box on the voting instruction card you received and return it to your broker, bank or other nominee or contact your broker, bank or other nominee to obtain a legal proxy or follow the instructions on the Notice or voting instruction card that you received. Effect of Not Casting Your Vote Whether you hold your shares in street name as a beneficial owner, or you are a shareholder of record, it is critical that you cast your vote. If you hold your shares in street name, you must cast a vote if you want it to count in the election of directors (Proposal No. 1) and, in the shareholder advisory vote on the compensation of the Company’s named executive officers (Proposal No. 2). In the past, if you held your shares in street name, and you did not indicate how you wanted your shares voted in the election of directors, or on many other matters, your broker was allowedvote to vote those shares on your behalf as they felt appropriate. However, brokers no longerapprove amendments to the 2003 Plan (Proposal 3).

Brokers do not have the ability to vote your uninstructed shares in the election of directors on a discretionary basis, and brokers do not have any discretionary ability to vote shares on the advisory vote with respect to the compensation of the Company’s named executive officers.officers or the vote to approve the amendments to the 2003 Plan. Therefore, if you hold your shares in street name and you do not instruct your broker how to vote in the election of directors, (Proposal 1) or on the shareholder advisory vote on the compensation of the Company’s named executive officers (Proposal 2),Proposals 2 or 3, no vote will be cast on your behalf on the matter for which no instructions have been provided. Your broker will, however, continue to have discretion to vote any uninstructed shares on the ratification of the selection of KPMG LLP as the Company’s independent registered public accounting firm for fiscal 20192020 (Proposal No. 3)4). If you are a shareholder of record and you do not cast your vote, no votes will be cast on your behalf on any of the items of business at the Meeting, including the ratification of the appointment of the independent registered public accounting firm.

2

| Q: | | How can I attend the Meeting? |

| A: | | You may attend the Meeting in person if you are listed as a shareholder of record as of the close of business on March 20, 201918, 2020 and bring proof of your identification. |

| Additionally, as part of our precautions regarding the coronavirus orCOVID-19, we are holding our Meeting virtually on the Internet. If we are unable to have the Meeting at our offices, we will announce our decision to hold the Meeting only virtually via the Internet. |

| To participate in the Meeting virtually via the Internet, please visit www.meetingcenter.io/227440037. The password for the meeting is HAS2020. To participate in the Meeting virtually as a registered shareholder, you will need the control number included on your Notice of Internet Availability of Proxy Materials or your proxy card. If you hold your shares through an intermediary, such as a bank or broker, please refer to the instructions in “How do I register to attend the meeting virtually via the Internet?” below.Stockholders who attend the Meeting virtually via the Internet will have the opportunity to participate fully in the Meeting on an equal basis with those who attend in person. |

| If you hold your shares through a broker, bank or other nominee, you will need to provide proof of your share ownership by bringing either a copy of a brokerage or bank statement showing your share ownership as of March 20, 2019,18, 2020, and a legal proxy if you wish to vote your shares in person atduring the Meeting. In addition to the items mentioned above, you should bring proof of your identification. Further, if you hold your shares through a broker, bank or other nominees, and want to participate in the Meeting virtually via the Internet, you must register in advance using the instructions below. |

| Q: | How do I register to attend the Meeting virtually on the Internet? |

| A: | If you are a registered shareholder (i.e., you hold your shares through our transfer agent, Computershare), you do not need to register to attend the Meeting virtually on the Internet. Please follow the instructions on the notice or proxy card that you received. |

| If you hold your shares in street name as a beneficial owner, you must register in advance to attend the Meeting virtually on the Internet. To register to attend the Meeting online you must |

| submit proof of your proxy power (legal proxy) reflecting your holdings in Hasbro along with your name and email address to Computershare. Requests for registration must be labeled as “Legal Proxy” and be received no later than 5:00 p.m., Eastern Time, on May 4, 2020. |

| You will receive a confirmation of your registration by email after we receive your registration materials. Requests for registration should be directed to Computershare at the following: |

| By email: Forward the email from your broker, or attach an image of your legal proxy, to: |

| | | | | legalproxy@computershare.com. | | | | By mail: | | Computershare | | | Hasbro Legal Proxy | | | P.O. Box 43001 | | | Providence, RI 02940-3001 |

| Q: | How can I vote my shares in person atduring the Meeting? |

| A: | | Shares held directly in your name as the shareholder of record may be voted in person at the Meeting. Please bring proof of your identification to the meeting. Shares beneficially owned may be voted by you if you receive and present at the Meeting a legal proxy from your broker, bank or other nominee, together with proof of identification. Even if you plan to attend the Meeting, we recommend that you also vote in one of the ways described below so that your vote will be counted if you later decide not to attend the Meeting or are otherwise unable to attend. |

| Registered holders may also vote during the Meeting via the Internet by going to www.meetingcenter.io/227440037, entering in the meeting password HAS2020, clicking on the “Cast Your Vote” link and entering the control number included on your Notice of Internet Availability of Proxy Materials or, if you received a printed copy of the proxy materials, on your proxy card to be able to vote during the Meeting via the Internet. If you hold your shares in street name as a beneficial holder and wish to vote during the Meeting, follow the same process using the control number provided to you by Computershare after following the procedure outlined in “How do I register to attend the meeting virtually on the Internet” above. |

| Q: | | How can I vote my shares without attending the Meeting?Meeting in person or virtually? |

| A: | | Whether you hold shares directly as the shareholder of record or beneficially in street |

3

| name, you may direct your vote without attending the Meeting. You may vote by granting a proxy or, for shares held in street name, by submitting voting instructions to your broker, bank or other nominee. In most instances, you will be able to do this over the Internet, by telephone or by mail. Please refer to the summary instructions below, the instructions included on the Notice, and if you request printed proxy materials, the instructions included on your proxy card or, for shares held in street name, the voting instruction card provided by your broker, bank or other nominee. |

| | | | | | | | 2 | |  | | H A S B R O 2 0 1 9 P R O X Y S T A T E M E N T |

a proxy or, for shares held in street name, by submitting voting instructions to your broker, bank or other nominee. In most instances, you will be able to do this over the Internet, by telephone or by mail. Please refer to the summary instructions below, the instructions included on the Notice, and if you request printed proxy materials, the instructions included on your proxy card or, for shares held in street name, the voting instruction card provided by your broker, bank or other nominee.

| | | By Internet— If you have Internet access, you may submit your proxy from any location by following the Internet voting instructions on the Notice you received or by following the Internet voting instructions on the proxy card or voting instruction card sent to you. |

| | | By Telephone— You may submit your proxy by following the telephone voting instructions on the proxy card or voting instruction card sent to you. |

| | | By Mail— You may do this by marking, dating and signing your proxy card or, for shares held in street name, the voting instruction card provided to you by your broker or nominee, and mailing it in the enclosed, self-addressed, postage prepaid envelope. No postage is required if mailed in the United States. Please note that for Hasbro shareholders, other than those shareholders holding their shares through the Hasbro 401(k) Retirement Savings Plan who are all being mailed a printed set of proxy materials, you will only be mailed a printed set of the proxy materials, including a printed proxy card or printed voting instruction card, if you request that such printed materials be sent to you. You may request a printed set of proxy materials by following the instructions in the Notice. |

| | | Please note that you cannot vote by marking up the Notice of Internet Availability of the Proxy Materials and mailing that Notice back. Any votes returned in that manner will not be counted. |

| Q: | | What is the quorum for the Meeting? |

| A: | | Holders of record of the Common Stock at the close of business on March 20, 201918, 2020 are entitled to vote at the Meeting or any adjournments thereof. As of that date, there were 125,996,661137,006,950 shares of Common Stock outstanding and entitled to vote and a majority of the outstanding shares will constitute a quorum for the transaction of business |

| at the Meeting. Abstentions and brokernon-votes are counted as present at the Meeting for purposes of determining whether there is a quorum at the Meeting. A brokernon-vote occurs when a broker holding shares for a customer does not vote on a particular proposal because the broker has not received voting instructions on the matter from its customer and is barred by stock exchange rules from exercising discretionary authority to vote on the matter. |

| Q: | | What vote is required to approve each proposal? |

| A: | | The vote required to approve each proposal is: |

Proposal 1— Election of DirectorsDirectors.:Under the Company’s majority vote standard, in order to be elected a director must receive a number of “For” votes that exceed the number of votes cast “Against” the election of the director. Proposal 2—Advisory Vote on CompensationCompensation.: The affirmative vote of a majority of the shares of Common Stock present (in person or by proxy) and entitled to vote at the Meeting on this shareholder advisory vote is required for approval of this proposal. Proposal 3— Approve Amendments to the 2003 Plan. The affirmative vote of a majority of the shares of Common Stock present (in person or by proxy) and entitled to vote at the Meeting on the amendments to the 2003 Plan is required for approval this proposal. Proposal 4—Ratification of the Selection of KPMGKPMG.: The affirmative vote of a majority of the shares of Common Stock present (in person or by proxy) and entitled to vote at the Meeting on the ratification of the selection of KPMG is required for approval of this proposal. | A: | | Each share of Common Stock entitles its holder to one vote on all matters to come before the Meeting, including the election of directors. In the election of directors, for each of the nominees you may vote “FOR” such nominee, “AGAINST” such nominee, or you may “ABSTAIN” from voting with respect to such nominee. For proposals 2, 3 and 3,4, you may vote “FOR”, “AGAINST” or “ABSTAIN”.“ABSTAIN.” If you “ABSTAIN”, for proposal 2, 3 or 4, it has the same effect as a vote “AGAINST” the proposal on proposals 2 and 3.that proposal. |

| | | If you properly sign and return your proxy card or complete your proxy via the Internet or telephone, |

4

| your shares will be voted as you direct. If you sign and submit your proxy card or voting instruction card with no instructions, your shares will be voted in accordance with the recommendations of the Board. |

| | | If you are a shareholder of record and do not vote via the Internet, via telephone, return a signed proxy card, or vote in person ator virtually via the Internet during the Meeting, your shares will not be voted. |

| | | If you are a beneficial shareholder and do not vote via the Internet, telephone, in person atduring the Meeting or by returning a signed voting instruction card, your shares may only be voted in situations where brokers have discretionary voting authority over the shares. Discretionary voting authority is only permitted on the proposal for the ratification of the selection of KPMG as the Company’s independent registered public accounting firm for 2019.2020. |

| | | | | | | | 3 | |  | | H A S B R O 2 0 1 9 P R O X Y S T A T E M E N T |

| Q: | | What is the recommendation of our Board on each of the matters scheduled to be voted on at the Meeting? |

| A: | | Our Board recommends that you vote:vote “FOR” each of the nominees for director (Proposal 1) and “FOR” each of Proposals 2, 3 and 4. |

“FOR” each of the nominees for director (Proposal 1);

“FOR” the advisory vote to approve the compensation for the Company’s named executive officers (Proposal 2); and

“FOR” the ratification of the selection of KPMG as the Company’s independent registered public accounting firm for fiscal 2019 (Proposal 3).

| Q: | | Can I change my vote or revoke my proxy? |

| A: | | You may change your proxy instructions at any time prior to the vote at the Meeting. For shares held directly in your name, you may accomplish this by granting another proxy that is properly signed and bears a later date, by sending a properly signed written notice to the Secretary of the Company or by attending the Meeting and voting in person. To revoke a proxy previously submitted by telephone or through the Internet, you may simply vote again at a later date, using the same procedures, in which case your later submitted vote will be recorded and your earlier vote revoked. Attendance at the Meeting will not cause your previously granted proxy to be revoked unless you specifically so request. For shares held beneficially by you, you may change your vote by submitting new voting instructions to your broker or nominee. |

| Q: | | What does it mean if I receive more than one Notice or more than one proxy or voting instruction card? |

| A: | | It means your shares are registered differently or are held in more than one account. Please provide |

| voting instructions for all Notices or proxy and voting instruction cards you receive. |

| Q: | | Where can I find the voting results of the Meeting? |

| A: | | We will announce preliminary voting results at the Meeting. We will publish final voting results in a Current Report on Form8-K within a few days following the Meeting. |

| Q: | | What happens if I have previously consented to electronic delivery of the Proxy Statement and other annual meeting materials? |

| A: | | If you have previously consented to electronic delivery of the annual meeting materials you will receive an email notice with instructions on how to access the Proxy Statement, notice of meeting and annual report on the Company’s website, and the proxy card for registered shareholders and voting instruction card for beneficial or “street name” shareholders, on the voting website. The notice will also inform you how to vote your proxy over the Internet. You will receive this email notice at approximately the same time paper copies of the Notice, or annual meeting materials are mailed to shareholders who have not consented to receive materials electronically. Your consent to receive the annual meeting materials electronically will remain in effect until you specify otherwise. |

| Q: | | If I am a shareholder of record how do I consent to receive my annual meeting materials electronically? |

| A: | | Shareholders of record who choose to vote their shares via the Internet will be asked to choose a current and future delivery preference prior to voting their shares. After entering the access information requested by the electronic voting site, click “Submit” and then respond as to whether you would like to receive current proxy material electronically or by mail. If you already have access to the materials, choose that option and click the “Next” button. On the following screen, choose whether you would like to receive future proxy materials bye-mail (and enter and verify youre-mail address), by mail or make no change or no preference and click “Next.” During the year, shareholders of record may sign up to receive their future annual meeting materials electronically over the Internet by going toregistering your account at www.computershare.com/investor.investor and updating your communication preferences. Shareholders of record with multiple Hasbro accounts will need to consent to electronic delivery for each account separately. |

| | | | | | | | 4 | |  | | H A S B R O 2 0 1 9 P R O X Y S T A T E M E N T |

5

ELECTION OF DIRECTORSElection of Directors (Proposal No. 1)

ThirteenYou are being asked to elect thirteen directors are to be elected at the Meeting. All of the directors elected at the Meeting will serve until the 20202021 Annual Meeting of Shareholders (the “2020“2021 Meeting”), and until their successors are duly elected and qualified, or until their earlier death, resignation or removal.

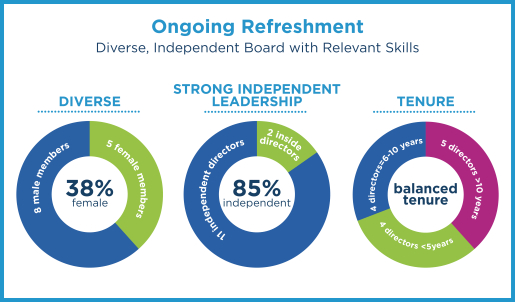

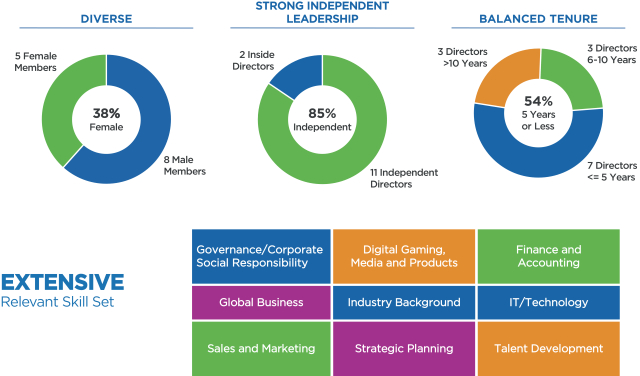

The Board, upon recommendation of the Nominating, Governance and Social Responsibility Committee of the Board, has recommended the persons named below as nominees for election as directors to serve until the 2020 Meeting, the persons named below.2021 Meeting. All of the nominees are currently directors of the Company. The proxies cannot be voted for more than thirteen directors at the Meeting. Unless otherwise specified in your voting instructions, the shares voted pursuant thereto will be cast “FOR” the persons named below as nominees for election as directors. If, for any reason, any of the nominees named below should be unable to serve as a director, it is intended that such proxy will be voted for the election, in his or her place, of a substituted nominee who would be recommended by the Board. The Board, however, has no reason to believe that any nominee named below will be unable to serve as a director. Selection of Board Nominees In considering candidates for election to the Board, the Board,board, the Nominating, Governance and Social Responsibility Committee ofand the Board and the Company consider a number of factors, including employment and other experience, qualifications, attributes, skills, expertise and involvement in areas that are of importance to the Company’s business, business ethics and professional reputation, other board service, business, financial and strategic judgment, the Company’s needs, and the desire to have a Board that represents a diverse mix of backgrounds, perspectives and expertise. Each of the nominees for election to the Board at the Meeting has served in senior positions at complex organizations and has demonstrated a successful track record of strategic, business and financial planning, execution and operating skills in these positions. In addition, each of the nominees for election to the Board has proven experience in management and leadership development and an understanding of operating and corporate governance issues for a large multinational company. The following chart highlights certain skills, experience and characteristics possessed by the nominees for election to the Board. Further information on each nominee’s qualifications is provided below in the individual biographies. In addition to the skills listed below, our directors each have experience with oversight of risk management, as further described below under the heading “Role of the Board in Risk Oversight”.Oversight.” | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Bronfin | | | Burns | | | Cochran | | | Davis | | | Frascotti | | | Gersh | | | Goldner | | | Hassenfeld | | | Leinbach | | | Philip | | | Stoddart | | | West | | | Zecher | | | | | | | | | | | | | | | | EXPERIENCE | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Senior Management | | ● | | | | ● | | | | ● | | | | ● | | | | ● | | | | ● | | | | ● | | | | ● | | | | ● | | | | ● | | | | ● | | | | ● | | | | ● | | | | | | | | | | | | | | | | | Industry Background | | ● | | | | ● | | | | ● | | | | ● | | | | ● | | | | ● | | | | ● | | | | ● | | | | | | | | ● | | | | ● | | | | ● | | | | ● | | | | | | | | | | | | | | | | | Sales and Marketing | | ● | | | | ● | | | | ● | | | | ● | | | | ● | | | | ● | | | | ● | | | | ● | | | | ● | | | | | | | | ● | | | | ● | | | | ● | | | | | | | | | | | | | | | | | Strategic Planning | | ● | | | | ● | | | | ● | | | | ● | | | | ● | | | | ● | | | | ● | | | | ● | | | | ● | | | | ● | | | | ● | | | | ● | | | | ● | | | | | | | | | | | | | | | | | Global Business | | ● | | | | ● | | | | ● | | | | ● | | | | ● | | | | ● | | | | ● | | | | ● | | | | ● | | | | ● | | | | ● | | | | ● | | | | ● | | | | | | | | | | | | | | | | | Digital Gaming/Media/ Products | | ● | | | | ● | | | | ● | | | | ● | | | | ● | | | | ● | | | | ● | | | | | | | | | | | | ● | | | | ● | | | | | | | | ● | | | | | | | | | | | | | | | | | Talent Development | | ● | | | | ● | | | | ● | | | | ● | | | | ● | | | | ● | | | | ● | | | | ● | | | | ● | | | | ● | | | | ● | | | | ● | | | | ● | | | | | | | | | | | | | | | | | Governance/ ESG | | ● | | | | ● | | | | ● | | | | ● | | | | ● | | | | ● | | | | ● | | | | ● | | | | ● | | | | ● | | | | ● | | | | ● | | | | ● | | | | | | | | | | | | | | | | | Finance/ Accounting | | ● | | | | ● | | | | ● | | | | | | | | | | | | ● | | | | | | | | | | | | ● | | | | ● | | | | ● | | | | | | | | | | | | | | | | | | | | | | | | | IT/Technology | | ● | | | | | | | | ● | | | | | | | | | | | | | | | | | | | Bronfin

| | Burns

| | Cochran

| | Davis

● | | | Frascotti

| ● | | | Gersh

| ● | | | Goldner

| | Hassenfeld

| | Leinbach

| ● | | | Philip

| | Stoddart

| | West

| | Zecher

| | | | | | | | | | | | | | | Experience

GENDER | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Senior Management

Female | | ● | | ● | | ● | | ● | | ● | | | ● | | ● | | ● | | ● | | | ● | | | ● | | ● | | | | | | | ● | | | | | | | | | | | | ● | | | | ● | | | | | | | | | | | | | | | | | Industry Background

Male | | ● | | ● | | ● | | ● | | ● | | ● | | ● | | ● | | | | ● | | ● | | ● | | ● | | | | | | | | | | | | | | | Sales and Marketing

| | ● | | ● | | ● | | ● | | ● | | ● | | ● | | ● | | ● | | | | ● | | ● | | ● | | | | | | | | | | | | | | | Strategic Planning

| | ● | | ● | | ● | | ● | | ● | | ● | | ● | | ● | | ● | | ● | | ● | | ● | | ● | | | | | | | | | | | | | | | Global Business

| | ● | | ● | | ● | | ● | | ● | | ● | | ● | | ● | | ● | | ● | | ● | | ● | | ● | | | | | | | | | | | | | | | Digital Gaming/Media/ Products

| | ● | | ● | | ● | | ● | | ● | | ● | | ● | | | | | | ● | | ● | | | | ● | | | | | | | | | | | | | | | Talent Development

| | ● | | ● | | ● | | ● | | ● | | ● | | ● | | ● | | ● | | ● | | ● | | ● | | ● | | | | | | | | | | | | | | | Governance/ Corporate Social Responsibility

| | ● | | ● | | ● | | ● | | ● | | ● | | ● | | ● | | ● | | ● | | ● | | ● | | ● | | | | | | | | | | | | | | | Finance/ Accounting

| | ● | | ● | | ● | | | | | | ● | | | | | | ● | | ● | | ● | | | | | | ● | | | | | | | | | | | | | | IT/Technology

| | ● | | | | ● | | | | | | | | | | | | ● | | ● | | ● | | | | ● | | | | | | | | | | | | | | | Gender

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Male

| | ● | | ● | | | | ● | | ● | | | | ● | | ● | | | | ● | | ● | | | | | | | | | | | | | | | | | | | Female

| | | | | | | ● | | | | ● | | | | | | | | ● | | | | ● | | | | | | | | ● | | | | ● | | | | | | | ● | | ● | |

| | | | | | | | 5 | |  | | H A S B R O 2 0 1 9 P R O X Y S T A T E M E N T |

6

Nominees for Election as Directors The following sets forth certain biographical information set forth below as toregarding each director nominee includes: (i) his or her age; (ii) all positions and offices with the Company; (iii) principal occupation or employment during the past five years; (iv) current directorshipsas of publicly-held companies or investment companies; (v) other previous directorships of publicly-held companies or investment companies during the past five years; (vi) period of serviceApril 1, 2020, as a director of the Company; and (vii)well as particular experience, qualifications, attributes or skills (beyond those indicated in the preceding chart), which led the Company’s Board to conclude that the nominee should serve as a director of the Company. Except as otherwise indicated, each person has had the same principal occupation or employment during the past five years. Nominees for Election as Directors

Kenneth A. Bronfin

Age: 59

Director Since: 2008

Committees:

• Compensation

• Cybersecurity and Data Privacy

• Finance

Experience and Qualifications

Kenneth A. Bronfin is Senior Managing Director of Hearst Ventures (the strategic investment division of diversified media, information and services company Hearst Corporation), serving in this role since 2013. Prior thereto, he was President of Hearst Interactive Media since 2002. Prior thereto, Mr. Bronfin was Deputy Group Head of Hearst Interactive Media since 1996.

The Board has nominated Mr. Bronfin for election as a director because of his extensive expertise and experience in operational and executive roles in the media and digital services sectors, as well as his experience in strategic planning and corporate finance. Mr. Bronfin’s experience includes serving in a number of executive positions where he was in charge of interactive media and digital businesses and where he led new business ventures, strategic investments and acquisitions in the digital content and media industries. Mr. Bronfin has experience serving on private and public company boards of directors. Mr. Bronfin possesses substantial knowledge, expertise and experience, including operations and business planning experience, in the media, digital products and digital services industries, including expertise in international media, advertising, marketing, and analyzing and anticipating consumer trends.

Other Current Public Company Boards

Former Public Company Boards Held in the Past Five Years

| | | | | | | | 6

| | Kenneth A. Bronfin

Director Since:2008 Committees: • Audit • Compensation • Cybersecurity and

Data Privacy | | | H A S B R O 2 0 1 9 P R O X Y S T A T E M E N T EXPERIENCE

Kenneth A. Bronfin is Senior Managing Director of Hearst Ventures (the strategic investment division of diversified media, information and services company Hearst Corporation), serving in this role since 2013. Prior to that, he served as President of Hearst Interactive Media since 2002, and Deputy Group Head of Hearst Interactive Media since 1996. | | | QUALIFICATIONS • Extensive expertise and experience in operational and executive roles in the media and digital services sectors, as well as experience in strategic planning and corporate finance. • Experience in a number of executive positions where he was in charge of interactive media and digital businesses and where he led new business ventures, strategic investments and acquisitions in the digital content and media industries. • Experience serving on private and public company boards of directors. • Substantial knowledge, expertise and experience, including operations and business planning experience, in the media, digital products and digital services industries, including expertise in international media, advertising, marketing, and analyzing and anticipating consumer trends. | | | OTHER CURRENT PUBLIC COMPANY BOARDS • None | | | FORMER PUBLIC COMPANY BOARDS HELD IN THE PAST FIVE YEARS • None | | |

Michael R. Burns

Age: 60

Director Since: 2014

Committees:

• Finance

• Nominating, Governance and Social Responsibility

Experience and Qualifications

Michael R. Burns is the Vice Chairman and a member of the board of directors of Lions Gate Entertainment Corp. (a global entertainment company with significant motion picture and television operations), serving in this role since 2000. Lions Gate acquired Starz in December 2016. From 1991 to 2000, Mr. Burns was the Managing Director and Head of the Los Angeles Investment Banking Office of Prudential Securities Inc.

The Board has nominated Mr. Burns for election as a director because of his extensive knowledge and experience in content development and brand building, including in the use of creative storytelling and immersive entertainment across platforms to build global entertainment franchises, in the entertainment industry, including operating and financial expertise in motion picture and television development, production, financing, marketing, distribution and monetization, and expertise in strategic planning for, investing in and building content and entertainment-driven multi-platform businesses. Mr. Burns also possesses expertise in investment banking, corporate finance, and international business.

Other Current Public Company Boards

Lions Gate Entertainment Corp.

Former Public Company Boards Held in the Past Five Years

Hope F. Cochran

Age: 47

Director Since: 2016

Committees:

• Audit (Chair)

• Executive

• Finance

Experience and Qualifications

Hope Cochran is a Managing Director at Madrona Venture Group (a technology-focused venture capital group). Prior to joining Madrona in January 2017, Ms. Cochran was the Chief Financial Officer of King Digital Entertainment from 2013 to 2016. From 2005 to 2013, Ms. Cochran was the Chief Financial Officer for Clearwire, Inc.

The Board has nominated Ms. Cochran for election as a director because of her extensive experience spanning more than 20 years as a senior financial executive in the digital gaming and telecom industries, her knowledge of how to develop digital content businesses, her expertise in managing global teams, and her talent in managing, growing and overseeing global businesses. Ms. Cochran also possesses international business expertise, substantial experience as a public company chief financial officer, and expertise in financial and accounting issues for large public companies. The Board has determined that Ms. Cochran qualifies as an Audit Committee Financial Expert due to her prior experience, including as a Chief Financial Officer of public companies.

Other Current Public Company Boards

Former Public Company Boards Held in the Past Five Years

| | | | | | | | | |

| | 7Michael R. Burns

Age:61 Director Since:2014 Committees: • Finance • Nominating, Governance and Social Responsibility | |  | EXPERIENCE Michael R. Burns is the Vice Chairman and a member of the board of directors of Lions Gate Entertainment Corp. (a global entertainment company with significant motion picture and television operations), serving in this role since 2000. Lions Gate acquired Starz in December 2016. From 1991 to 2000, Mr. Burns was the Managing Director and Head of the Los Angeles Investment Banking Office of Prudential Securities Inc. | | | H A S B R O 2 0 1 9 P R O X Y S T A T E M E N T QUALIFICATIONS

• Extensive knowledge and experience in content development and brand building, including in the use of creative storytelling and immersive entertainment across platforms to build global entertainment franchises. • Significant experience in the entertainment industry, including operating and financial expertise in motion picture and television development, production, financing, marketing, distribution and monetization. • Expertise in strategic planning for, investing in and building content and entertainment-driven multi-platform businesses. • Investment banking, corporate finance, and international business experience. | | | OTHER CURRENT PUBLIC COMPANY BOARDS • Lions Gate Entertainment Corp. | | | FORMER PUBLIC COMPANY BOARDS HELD IN THE PAST FIVE YEARS • None |

7

Sir Crispin H. Davis

Age: 70

Director Since: 2016

Committees:

• Compensation

• Nominating, Governance and Social Responsibility

Experience and Qualifications

Sir Crispin H. Davis served as the Chief Executive Officer of Reed Elsevier, PLC (a leading provider of scientific, legal and business publishing) from 1999 to 2009. From 1994 to 1999 he was the Chief Executive Officer of Aegis Group, PLC (media and digital marketing communications company).

The Board has nominated Sir Davis for election as a director because of his experience and success transforming a print-based publishing company into a leading online information provider, international business expertise, proven leadership in driving the growth of large multinational corporations, expertise in brand building, organizational development and global marketing, background in media and digital marketing, and knowledge of corporate governance and board best practices.

Other Current Public Company Boards

Former Public Company Boards Held in the Past Five Years

| | | | | | | | 8

| | Hope F. Cochran

Director Since:2016 Committees: • Audit (Chair) • Executive • Finance | | | H A S B R O 2 0 1 9 P R O X Y S T A T E M E N T EXPERIENCE

Hope F. Cochran is a Managing Director at Madrona Venture Group (a technology-focused venture capital group). Prior to joining Madrona in January 2017, Ms. Cochran was the Chief Financial Officer of King Digital Entertainment from 2013 to 2016. From 2005 to 2013, Ms. Cochran was the Chief Financial Officer for Clearwire, Inc. | | | QUALIFICATIONS • Extensive experience spanning more than 20 years as a senior financial executive in the digital gaming and telecom industries. • Significant knowledge of development of digital content businesses. • International business expertise in managing global teams, and talent in managing, growing and overseeing global businesses. • Substantial experience as a chief financial officer and overseeing financial and accounting issues for public companies. | | | OTHER CURRENT PUBLIC COMPANY BOARDS • MongoDB, Inc. • New Relic, Inc. | | | FORMER PUBLIC COMPANY BOARDS HELD IN THE PAST FIVE YEARS • None | | |

John A. Frascotti

Age: 58

Director Since: 2018

Committees:

• None

Experience and Qualifications

John A. Frascotti has served as President and Chief Operating Officer and a Director of the Board of Hasbro, Inc. since August 2018. Mr. Frascotti is responsible for leading a global organization focused on creating and delivering the world’s best play and entertainment experiences across Hasbro’s Brand Blueprint, including toys and games, immersive entertainment experiences, digital gaming and consumer products. Prior to his current position, Mr. Frascotti held the positions of President, Hasbro, Inc. from 2017 until August 2018, President, Hasbro Brands from 2014 to 2017, and Executive Vice President and Chief Marketing Officer from 2008 to 2014. Before joining Hasbro in 2008, Mr. Frascotti served as a Senior Vice President of Sports Division at Reebok International, Ltd. and in a number of other senior marketing and licensing positions with Reebok. Mr. Frascotti also practiced law in Los Angeles at Mitchell, Silberberg & Knupp and in Boston at Palmer & Dodge. Mr. Frascotti serves as an officer and/or director of a number of Hasbro subsidiaries and joint ventures at the request and convenience of the Company, including as a member of the Board of Discovery Family Channel, a joint venture between Hasbro and Discovery Communications. He also serves as the Chair of Hasbro’s IP Security Committee and is a member of Hasbro’s Global Information Systems Steering Committee.

The Board has nominated Mr. Frascotti for election as a director because of his extensive knowledge, expertise and leadership in marketing, brand management, licensing, acquisitions and other strategic transactions, global operations, and talent development. He has played and continues to play a critical role in there-imagination andre-invention of key Hasbro brands, including TRANSFORMERS, NERF, MY LITTLE PONY, BABY ALIVE, MONOPOLY, MAGIC: THE GATHERING andPLAY-DOH, in addition to Hasbro’s Gaming Business, and its portfolio of Partner and Emerging Brands. Mr. Frascotti’s experience and strategic insights into brand building, digital marketing, consumer products, and entertainment have greatly contributed to the expanded global reach of Hasbro’s brands. He was recognized by Forbes Magazine as one of top 5 most influential CMO’s among the top 500 companies in Forbes Global 2000 Biggest Public Companies list. In his role as a director of Corus Entertainment Inc., a Canadian public company focused on creating and delivering high quality brands and content for audiences around the world, Mr. Frascotti has gained further experience and insights in media and content delivery. Outside of the play, media and entertainment industry, Mr. Frascotti gives back to the community through this service on the Board of Directors of the Serious Fun Children’s Network, anon-profit global network of camps for seriously ill children, and the advisory board of Newman’s Own, which provides high-level advice and assistance on strategic matters to both Newman’s Own Foundation and the food company, Newman’s Own, Inc.

Other Current Public Company Boards

Former Public Company Boards Held in the Past Five Years

| | | | | | | | | |

| | 9Sir Crispin H. Davis

Age:71 Director Since:2016 Committees: • Compensation • Finance • Nominating, Governance and Social Responsibility | |  | EXPERIENCE Sir Crispin H. Davis served as the Chief Executive Officer of Reed Elsevier, PLC (a leading provider of scientific, legal and business publishing) from 1999 to 2009. From 1994 to 1999 he was the Chief Executive Officer of Aegis Group, PLC (a media and digital marketing communications company). | | | H A S B R O 2 0 1 9 P R O X Y S T A T E M E N T QUALIFICATIONS

• Experience and success transforming a print-based publishing company into a leading online information provider. • Proven leadership in driving the growth of large multinational corporations. • Expertise in brand building, organizational development and global marketing, media and digital marketing. • International business experience, and significant knowledge of corporate governance and board best practices. | | | OTHER CURRENT PUBLIC COMPANY BOARDS • Vodaphone Group, PLC | | | FORMER PUBLIC COMPANY BOARDS HELD IN THE PAST FIVE YEARS • Rentokil Initial PLC |

8

Lisa Gersh

Age: 60

Director Since: 2010

Committees:

• Audit

• Compensation

Experience and Qualifications

Lisa Gersh served as the Chief Executive Officer of Alexander Wang (a global fashion brand) from October 2017 to October 2018. Ms. Gersh served as the Chief Executive Officer of Goop, Inc. (lifestyle publication curated by Gwyneth Paltrow) from 2014 to 2016. Ms. Gersh served as President and Chief Executive Officer of Martha Stewart Living Omnimedia, Inc. (integrated media and merchandising company) from 2012 to 2013. Prior thereto, she served as President and Chief Operating Officer of Martha Stewart Living Omnimedia, Inc. from 2011 to 2012. Ms. Gersh served as a director of Martha Stewart Living Omnimedia, Inc. from 2011 to 2013.

The Board has nominated Ms. Gersh for election as a director because of her extensive experience in the media, branded products and entertainment industries, including television, digital entertainment and publishing. These roles involved operating and executive positions with multiple leading media and brand-driven companies, including as Chief Executive Officer of Alexander Wang, Chief Executive Officer of Goop, Inc., President and Chief Executive Officer of Martha Stewart Living Omnimedia and President of Oxygen Media. Ms. Gersh possesses expertise in business and strategic planning, expertise in the media, retail, brand-driven and entertainment industries, including the cable television and digital industries, and expertise in marketing and branding, media trends and in building global brand-driven businesses. The Board has determined that Ms. Gersh qualifies as an Audit Committee Financial Expert due to her prior experience, including her service on public company audit committees and experience as the Chief Executive Officer overseeing Chief Financial Officers of a public company.

Other Current Public Company Boards

Former Public Company Boards Held in the Past Five Years

| | | | | | | | 10

| | John A. Frascotti

Director Since:2018 Committees: • None | | | H A S B R O 2 0 1 9 P R O X Y S T A T E M E N T EXPERIENCE

John A. Frascotti has served as President and Chief Operating Officer and a Director of the Board of Hasbro, Inc. since August 2018. Mr. Frascotti is responsible for leading a global organization focused on creating and delivering the world’s best play and entertainment experiences across Hasbro’s Brand Blueprint, including toys and games, immersive entertainment experiences, digital gaming and consumer products. Prior to his current position, Mr. Frascotti held the positions of President, Hasbro, Inc. from 2017 until August 2018, President, Hasbro Brands from 2014 to 2017, and Executive Vice President and Chief Marketing Officer from 2008 to 2014. Before joining Hasbro in 2008, Mr. Frascotti served as a Senior Vice President of Sports Division at Reebok International, Ltd. and in a number of other senior marketing and licensing positions with Reebok. Mr. Frascotti also practiced law in Los Angeles at Mitchell, Silberberg & Knupp and in Boston at Palmer & Dodge. | | | QUALIFICATIONS • Extensive knowledge, expertise and leadership in marketing, brand management, licensing, acquisitions and other strategic transactions, global operations, and talent development. • Critical role in there-imagination andre-invention of key Hasbro brands. • Experience and strategic insights into brand building, digital marketing, consumer products, and entertainment, which have greatly contributed to the expanded global reach of Hasbro’s brands. • Recognized by Forbes Magazine as one of top 5 most influential CMO’s among the top 500 companies in Forbes Global 2000 Biggest Public Companies list. • Significant experience in media and content delivery gained through his experience as a director with a Canadian public company focused on creating and delivering high quality brands and content for audiences around the world. • Community service leader through service on the Board of Directors of the Serious Fun Children’s Network, anon-profit global network of camps for seriously ill children, and the advisory board of Newman’s Own, which provides high-level advice and assistance on strategic matters to both Newman’s Own Foundation and the food company, Newman’s Own, Inc. | | | OTHER CURRENT PUBLIC COMPANY BOARDS • Party City Holdco Inc. | | | FORMER PUBLIC COMPANY BOARDS HELD IN THE PAST FIVE YEARS • Corus Entertainment Inc. | | |

Brian D. Goldner

Age: 55

Director Since: 2008

Committees:

• Executive

Experience and Qualifications

Brian D. Goldner has served as the Chief Executive Officer of Hasbro, Inc. since 2008, and additionally has served as the Chairman of the Board since May 2015. In addition to being Chief Executive Officer, from 2008 to 2016 Mr. Goldner was also the President of Hasbro. Prior to 2008, Mr. Goldner served as the Chief Operating Officer of Hasbro from 2006 to 2008 and as President, U.S. Toys Segment from 2003 to 2006. Prior to joining Hasbro in 2000, Mr. Goldner held a number of management positions in the family entertainment and advertising industries, including as Executive Vice President and Chief Operating Officer of Bandai America, Worldwide Director in charge of the Los Angeles Office of J. Walter Thompson and as a Vice President and Account Director of Leo Burnett Advertising.

The Board has nominated Mr. Goldner for election as a director because of the fundamental role he has played and continues to play in the transformation of Hasbro’s business globally and in successfully formulating and executing the Company’s strategy, including its expansion into new geographies and new categories.

Mr. Goldner is the chief architect of the Company’s Brand Blueprint and has led the Company’s transformation from a traditional toy and game manufacturer into a global play and entertainment leader. Under Mr. Goldner’s leadership, Hasbro brands are more pervasive, more global, and more inclusive than ever before. Today, Hasbro brands are activated globally across toy and game, digital gaming, consumer products, esports, omni-channel content, publishing, music, and many more categories. Mr. Goldner has also evolved the Company’s retail strategy, and Hasbro is leading the industry in omni-channel retail activation and eCommerce growth.

Mr. Goldner pioneered Hasbro’s entry into entertainment and oversees the Company’s omni-channel storytelling. Through its film labels, Allspark Pictures and Allspark Entertainment, its animation studio, Boulder Media, itsin-house creative agency, Cake Mix Studios, and aco-production and distribution partnership with Paramount Pictures, Hasbro delivers stories across all content platforms. Mr. Goldner has also led the Company’s digital-first approach, engaging consumers in content to commerce solutions across multiple platforms.

Hasbro successfully now manages licenses with some of the most valuable properties in the industry, including Marvel, Star Wars, Disney Princess and Disney Frozen with The Walt Disney Company, Universal Dreamworks Trolls, Sesame Street and Beyblade. Under Mr. Goldner’s leadership, the company has also forged important relationships with trending properties that have a massive global fan base, such as Fortnite and Overwatch. Hasbro’s targeted fan strategy, centered ondirect-to-consumer content and commerce solutions, has deepened engagement among global audiences and delivered incremental growth across some of Hasbro’s most beloved brands. Mr. Goldner led the Company’s recent acquisition of Saban Brands, and is driving the Brand Blueprint activation of Power Rangers to maximize the opportunity surrounding that brand.

Mr. Goldner possesses knowledge, expertise and experience regarding strategic and operational planning and execution in global brand and entertainment industries. He has driven immersive play offerings and used storytelling to build global consumer franchises. His expertise in recognizing the industry’s trends and challenges, expertise in the media and entertainment industries, and experience in marketing, product and brand development have been paramount in developing the framework for creating multi-faceted brand experiences for fans, families, kids and audiences around the world.

Mr. Goldner also serves as an officer and/or director of a number of the Company’s subsidiaries at the request and convenience of the Company.

Other Current Public Company Boards

Former Public Company Boards Held in the Past Five Years

| | | | | | | | | |

| | 11Lisa Gersh

Age:61 Director Since:2010 Committees: • Audit • Compensation (Chair) • Executive | |  | EXPERIENCE Lisa Gersh is an outside advisor to companies investing in the media space. She previously served as the Chief Executive Officer of Alexander Wang (a global fashion brand) from October 2017 to October 2018. Ms. Gersh served as the Chief Executive Officer of Goop, Inc. (lifestyle publication curated by Gwyneth Paltrow) from 2014 to 2016, and President and Chief Executive Officer of Martha Stewart Living Omnimedia, Inc. (integrated media and merchandising company) from 2012 to 2013. Prior to that, she served as President and Chief Operating Officer of Martha Stewart Living Omnimedia, Inc. from 2011 to 2012, and a director of Martha Stewart Living Omnimedia, Inc. from 2011 to 2013. | | | H A S B R O 2 0 1 9 P R O X Y S T A T E M E N T QUALIFICATIONS

• Extensive experience in the media, branded products and entertainment industries, including television, digital entertainment and publishing. • Operating and executive positions with multiple leading media and brand-driven companies, including as Chief Executive Officer of Alexander Wang, Chief Executive Officer of Goop, Inc., President and Chief Executive Officer of Martha Stewart Living Omnimedia and President andco-founder of Oxygen Media. • Expertise in business and strategic planning, in media, retail, brand-driven and entertainment industries, including the cable television and digital industries. • Skilled and highly knowledgeable in marketing and branding, media trends and in building global brand-driven businesses. | | | OTHER CURRENT PUBLIC COMPANY BOARDS • Establishment Labs Holdings Inc. | | | FORMER PUBLIC COMPANY BOARDS HELD IN THE PAST FIVE YEARS • comScore, Inc. |

9

Alan G. Hassenfeld

Age: 70

Director Since: 1978

Committees:

• Cybersecurity and Data Privacy

• Executive (Chair)

• Finance

Experience and Qualifications

Alan G. Hassenfeld served as Chairman of the Board of Hasbro, Inc. from 1989 to 2008. Prior to May 2003, Mr. Hassenfeld served as Chairman of the Board and Chief Executive Officer of Hasbro since 1999. Prior thereto, he was Chairman of the Board, President and Chief Executive Officer of Hasbro since 1989. Mr. Hassenfeld isco-chairman of the Governing Body of the International Council of Toy Industries CARE Process, Chairman of the Jerusalem Foundation, andCo-Chair of the International Business School at Brandeis University.

The Board has nominated Mr. Hassenfeld for election as a director because of his more than 40 years of experience in the toy, game and family entertainment industry, including his extensive service in senior leadership roles at Hasbro, culminating in his service as the Company’s Chairman of the Board and Chief Executive Officer. Throughout his career at Hasbro, Mr. Hassenfeld held a number of positions of increasing responsibility in marketing and sales for the Company’s domestic and international operations, including responsibilities overseeing global markets. He became Vice President of International Operations in 1972 and later served as Vice President of Marketing and Sales and then as Executive Vice President, prior to being named President of the Company in 1984 and President and Chief Executive Officer in 1989. The Board believes Mr. Hassenfeld possesses particular knowledge, expertise and experience regarding strategic and operational planning and execution in the toy, game and family entertainment industries, expertise in industry trends and challenges, global markets, and international business operations, expertise in issues of corporate social responsibility and sustainability, and experience and expertise in the competitive and financial positioning of the Company and its business.

Other Current Public Company Boards

Former Public Company Boards Held in the Past Five Years

| | | | | | | | 12

| | Brian D. Goldner

Director Since:2008 Committees: • None | | | H A S B R O 2 0 1 9 P R O X Y S T A T E M E N T EXPERIENCE

Brian D. Goldner has served as the Chief Executive Officer of Hasbro, Inc. since 2008, and has served as the Chairman of the Board since May 2015. In addition to being Chief Executive Officer, from 2008 to 2016, Mr. Goldner was also the President of Hasbro. Prior to 2008, Mr. Goldner served as the Chief Operating Officer of Hasbro from 2006 to 2008 and as President, U.S. Toys Segment from 2003 to 2006. Prior to joining Hasbro in 2000, Mr. Goldner held a number of management positions in the family entertainment and advertising industries, including as Executive Vice President and Chief Operating Officer of Bandai America, Worldwide Director in charge of the Los Angeles Office of J. Walter Thompson and as a Vice President and Account Director of Leo Burnett Advertising. | | | QUALIFICATIONS • Chief architect in the transformation of Hasbro’s business globally and in successfully formulating, executing and accelerating the Company’s Brand Blueprint strategy, leading the Company’s evolution from a traditional toy and game manufacturer into a global play and entertainment leader, including most recently through his leadership in the acquisition of eOne. • Possesses knowledge, expertise and experience regarding strategic and operational planning and execution in global brand and entertainment industries. He has driven immersive play offerings and used storytelling to build global consumer franchises. His expertise in recognizing the industry’s trends and challenges, expertise in the media and entertainment industries, and experience in marketing, product and brand development have been paramount in developing the framework for creating multi-faceted brand experiences for fans, families, kids and audiences around the world. • Pioneered Hasbro’s entry into entertainment and oversees the Company’s omni-channel storytelling, through eOne’s television, film and music business and Hasbro’s film labels, animation studio,in-house creative agency, and aco-production and distribution partnership with Paramount Pictures. • Led the Company’s digital-first approach, engaging consumers in content to commerce solutions across multiple platforms. • Forged important relationships with some of the most valuable properties in the industry, including Marvel, Star Wars, Disney Princess and Disney Frozen with The Walt Disney Company, Universal Dreamworks Trolls, Sesame Street and Beyblade, as well as trending properties that have a massive global fan base, such as Fortnite and Overwatch. | | | OTHER CURRENT PUBLIC COMPANY BOARDS • ViacomCBS Inc. | | | FORMER PUBLIC COMPANY BOARDS HELD IN THE PAST FIVE YEARS • Molson Coors Brewing • The Gap, Inc. | | |

Tracy A. Leinbach

Age: 59

Director Since: 2008

Committees:

• Audit

• Executive

• Nominating, Governance and Social Responsibility (Chair)

Experience and Qualifications

Tracy A. Leinbach served as the Executive Vice President and Chief Financial Officer for Ryder System, Inc. (a global logistics and transportation and supply chain solutions provider) from 2003 until 2006. Prior thereto, Ms. Leinbach served as Executive Vice President, Fleet Management Solutions for Ryder since 2001.

The Board has nominated Ms. Leinbach for election as a director because of her extensive business experience in global operations, strategic and financial planning, auditing and accounting. Ms. Leinbach held a number of positions involving increasing global operating and global financial management, responsibility and oversight, as well as global supply chain management, with Ryder, spanning a career with Ryder of over 21 years. During her career she led the company’s largest business unit in the U.S., as well as units in Europe, Mexico and Canada. In addition to extensive operating experience, her time with Ryder included service as controller and chief financial officer at many of Ryder’s subsidiaries and divisions. Ms. Leinbach’s career with Ryder culminated in her service as Executive Vice President and Chief Financial Officer. Prior to her career with Ryder, Ms. Leinbach worked for PricewaterhouseCoopers in public accounting and was a CPA. The Board believes Ms. Leinbach possesses knowledge, expertise and experience in strategic planning, management, operations, logistics and risk management for a large multinational company, corporate finance, sales, and expertise in issues regarding financial reporting and accounting issues for large public companies. The Board has determined that Ms. Leinbach qualifies as an Audit Committee Financial Expert due to her prior experience, including as the Chief Financial Officer of a public company (Ryder System, Inc.).

Other Current Public Company Boards

Former Public Company Boards Held in the Past Five Years

| | | | | | | | | |

| | 13Alan G. Hassenfeld

Age:71 Director Since:1978 Committees: • Cybersecurity and

Data Privacy • Executive (Chair) • Finance | |  | EXPERIENCE Alan G. Hassenfeld served as Chairman of the Board of Hasbro, Inc. from 1989 to 2008. Prior to May 2003, Mr. Hassenfeld served as Chairman of the Board and Chief Executive Officer of Hasbro since 1999, and Chairman of the Board, President and Chief Executive Officer of Hasbro since 1989. He also served as Vice President of International Operations in 1972 and later served as Vice President of Marketing and Sales and then as Executive Vice President, prior to being named President of the Company in 1984 and President and Chief Executive Officer in 1989. Mr. Hassenfeld isco-chairman of the Governing Body of the International Council of Toy Industries CARE Process, Chairman of the Jerusalem Foundation, andCo-Chair of the International Business School at Brandeis University. | | | H A S B R O 2 0 1 9 P R O X Y S T A T E M E N T QUALIFICATIONS

• More than 40 years of experience in the toy, game and family entertainment industry, including his extensive service in senior leadership roles at Hasbro, culminating in his service as the Company’s Chairman of the Board and Chief Executive Officer. • Throughout his career at Hasbro, Mr. Hassenfeld held a number of positions of increasing responsibility in marketing and sales for the Company’s domestic and international operations, including responsibilities overseeing global markets. • Possesses particular knowledge, expertise and experience regarding strategic and operational planning and execution in the toy, game and family entertainment industries. • Expertise in industry trends and challenges, global markets, international business operations, and in the competitive and financial positioning of companies such as Hasbro. • Expertise in issues of corporate social responsibility and sustainability. | | | OTHER CURRENT PUBLIC COMPANY BOARDS • Salesforce.com, Inc. | | | FORMER PUBLIC COMPANY BOARDS HELD IN THE PAST FIVE YEARS • None |

10

Edward M. Philip

Age: 53

Director Since: 2002

Committees:

• Compensation (Chair)

• Executive

• Nominating, Governance and Social Responsibility

Experience and Qualifications

Edward M. Philip served as the Chief Operating Officer of Partners in Health (anon-profit healthcare organization) from January 2013 to March 2017. In addition, Mr. Philip was a Special Partner at Highland Consumer Fund (consumer-oriented private equity fund), serving in this role from 2013 to 2017. He served as Managing General Partner at Highland Consumer Fund from 2006 to 2013. Prior thereto, Mr. Philip served as President and Chief Executive Officer of Decision Matrix Group, Inc. (research and consulting firm) from May 2004 to November 2005, and prior to that he was Senior Vice President of Terra Networks, S.A. (global Internet company) from October 2000 to January 2004. In 1995, Mr. Philip joined Lycos, Inc. (an Internet service provider and search company) as one of its founding members. During his time with Lycos, Mr. Philip held the positions of President, Chief Operating Officer and Chief Financial Officer at different times.

The Board has nominated Mr. Philip for election as a director because of his more than 25 years of business and management experience, including years of experience as both an operating executive and chief financial officer of multinational corporations, and his experience in strategic, business and financial planning in consumer-based and technology-based industries and in overseeing management teams of such companies, as well as in managing teams responding to complex and critical international issues. Mr. Philip possesses expertise regarding internet and technology-based industries, the use of the internet and digital media for building businesses, expertise in strategic planning and execution in complex global organizations, expertise in consumer trends and in the family entertainment industry, corporate finance, financial reporting and accounting matters for large multinational public companies, as well as in the operation and management of large multinational organizations.

Other Current Public Company Boards

United Continental Holdings, Inc.

Former Public Company Boards Held in the Past Five Years

| | | | | | | | 14

| | Tracy A. Leinbach

Director Since:2008 Committees: • Audit • Compensation • Nominating, Governance and Social Responsibility | | | H A S B R O 2 0 1 9 P R O X Y S T A T E M E N T EXPERIENCE

Tracy A. Leinbach served as the Executive Vice President and Chief Financial Officer for Ryder System, Inc. (a global logistics and transportation and supply chain solutions provider) from 2003 until 2006. Prior thereto, Ms. Leinbach served as Executive Vice President, Fleet Management Solutions for Ryder since 2001. Prior to her career with Ryder, Ms. Leinbach worked for PricewaterhouseCoopers in public accounting and was a CPA. | | | QUALIFICATIONS • Extensive business experience in global operations, strategic and financial planning, auditing and accounting. • Significant experience involving global operating and financial management, responsibility and oversight, as well as global supply chain management, with Ryder, spanning a career with Ryder of over 21 years. During her career she led the company’s largest business unit in the U.S., as well as units in Europe, Mexico and Canada. • Experience as a controller and chief financial officer at many of Ryder’s subsidiaries and divisions. • Possesses knowledge, expertise and experience in strategic planning, management, operations, logistics and risk management for a large multinational company, corporate finance, sales, and expertise in issues regarding financial reporting and accounting issues for large public companies. | | | OTHER CURRENT PUBLIC COMPANY BOARDS • Veritiv Corporation | | | FORMER PUBLIC COMPANY BOARDS HELD IN THE PAST FIVE YEARS • Forward Air Corporation | | |

Richard S. Stoddart

Age: 56

Director Since: 2014

Committees:

• Audit

• Cybersecurity and Data Privacy (Chair)

• Executive

• Nominating, Governance and Social Responsibility

Experience and Qualifications

Richard S. Stoddart is the President and Chief Executive Officer of InnerWorkings, Inc. (global marketing execution firm), serving in that role since 2017. Mr. Stoddart was the Chief Executive Officer of Leo Burnett Worldwide from February 2016 to 2017, the Chief Executive Officer of Leo Burnett North America from 2013 to 2016 and the President of Leo Burnett North America from 2005 to 2013.

The Board has nominated Mr. Stoddart for election as a director because of his extensive experience in the advertising, marketing and communications industries, including in television, digital, social media,point-of-sale, packaging and in print, and in building global brands and businesses. As the Chief Executive Officer of InnerWorkings, the largest global marketing execution company, Mr. Stoddart is recognized for his strategic and commercial leadership of the company, investor and analyst communications, and financial stewardship as well as his expertise in all facets of marketing execution and marketing supply chain management. In his prior role as Chief Executive Officer of one of the world’s largest advertising agencies, Mr. Stoddard was recognized for his leadership in the development and integration of shopper, digital, social and mobile capabilities as part of a company’s overall marketing and brand strategy. The Board believes Mr. Stoddart possesses knowledge, expertise and experience regarding branding and brand building, marketing and marketing strategy across media platforms, including in traditional advertising, digital advertising and social media; expertise in media planning, launching branded content and products; expertise in marketing production, logistics and execution; and expertise in media trends and strategic planning for businesses building content-driven brands.

Other Current Public Company Boards

Former Public Company Boards Held in the Past Five Years

Mary Beth West

Age: 56

Director Since: 2016

Committees:

• Executive

• Finance (Chair)

• Nominating, Governance and Social Responsibility

Experience and Qualifications

Mary Beth West is the Senior Vice President, Chief Growth Officer of The Hershey Company, serving in that role since May 2017. Ms. West served as Executive Vice President, Chief Customer & Marketing Officer of J.C. Penney Company from 2015 through March 2017. From 2012 to 2014 she was the Executive Vice President, Chief Category & Marketing Officer for Mondelez International, Inc. Prior thereto, she served as the Chief Marketing Officer for Kraft Foods, Inc. from 1986 to 2012.

The Board has nominated Ms. West for election as a director because of her extensive experience and expertise in marketing, brand building, managing global franchises, understanding and applying consumer insights, and in developing compelling retail and sales experiences. Ms. West also possesses expertise in strategic and operational planning and execution, skill in managing global teams and a proven track record in delivering top tier consumer experiences and in building global brands.

Other Current Public Company Boards

Former Public Company Boards Held in the Past Five Years

| | | | | | | | | |

| | 15Edward M. Philip